Top Warehouse Metrics to Track

Alex

2/24/2022

Similar Posts

All warehouse systems require implementing the correct warehouse metrics and KPIs (Key Performance Indicators) as they are crucial to identifying bottlenecks, planning out warehouse operations, maintaining efficiency, and measuring customer satisfaction. Warehouse data allows for a vast area of deep-dive analysis which is imperative to extract significant amounts of business intelligence insights that can later be used to detect trend changes and business development problems.

Metrics need to be organized in a meaningful way by outlining the individual purpose of each one and elaborating on the reasons why these align with the warehouse layout. It is necessary to analyze metrics for the five main areas of the warehouse, these are:

Receiving

Storage

Picking

Packing

Shipping

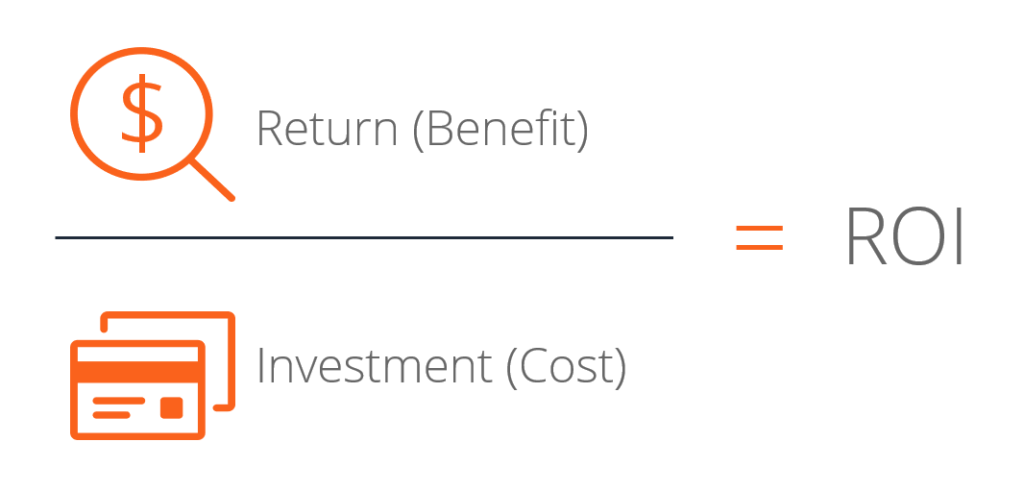

Carrying Cost of Inventory: Represents the total cost of holding inventory and quantifies the cost of the inventory value across all warehouse processes from receiving to shipping. This warehouse metric is represented as a percentage since it tells the percentage of total costs are wrapped up in the inventory alone compared with the costs to manage and move that inventory.

Carrying cost (%) = Inventory holding sum (Inventory service cost + Inventory risk cost + Capital cost + Storage cost) / Total value of inventory x 100

Rate of Return: Carefully keeping track of the returns is needed for the business, both the return number and the specific reason. Some of the main questions to ask are: Was the wrong item sent? Was it damaged? Did it arrive too late? Was the item not what the customer expected?

Return Rate = Total Returns / Total Orders

Backorder Rate: This is the rate at which the company receives incoming orders for out-of-stock items; this can indicate a failure to accurately forecast sales and timing of purchase order planning. This ratio can be influenced by either seasonal demand, consumer trends, or sales forecasts. These can contribute to a failure in attaining the first rule of inventory: Have enough inventory to service demand.

Back Order Rate = # of back orders / total # of orders

Order Lead Time: Refers to the total time it takes to fulfill an order, including picking, packing, and shipping. This rate applies to purchase orders as well which is equally important in determining how long it takes on average between when an order is placed with your vendor and when it arrives at your warehouse.

Lead Timing = Delivery Date - Order Date

Transportation Costs per Package: Refers to the labor, the equipment, and the safety gear required to move inventory around the warehouse. It is calculated as the cost sum for every 10 feet of movement. This highlights the importance of having an efficient warehouse layout and picking procedure.

Revenue per Employee: Tracking labor costs is important as employees generate revenue that keeps all the other KPIs in place, therefore low employee revenue means low overall warehouse efficiency.

Revenue Per Employee = Total Warehouse Revenue / Number of Employees

Order Accuracy: Every good fulfillment starts with accuracy, therefore employees in this area should match the order with what arrives and any issue should be flagged on the spot. Upgrading the ordering system or switching vendors should come as a response to having a low order accuracy. The average accuracy percentage for companies is 99.4%. This measure is partially dependent on the quality of your WMS and the owner’s understanding of its functionalities.

Order Accuracy Percentage = Total Order Errors / Total Orders * 100

Order Damage: The acceptable level of item breakage sits around 1%, anything above this proportion might call for considering alternative carrier options with the designated vendor.

Receiving Cycle time: This is simply the time that it takes for received stock to be counted, booked, and prepared for storage. This can unbalance other metrics if not given proper attention. Generally, items should be allocated as soon as they come into the warehouse but a good rule of thumb is to never wait longer than 24 hours unless there is a special circumstance such as quarantined goods or errors.

Inventory Turnover: Knowing what sits on the shelves and for how long it has been there is essential to improving purchasing decisions, in other words, the frequency of inventory sell-out is vital. The goal is comparing SKU speed as slow inventory will have to be shelved differently to prevent efficiency compromises and to detect downtrends in consumer buying behavior. This is one of the absolute must-have metrics.

Inventory Turnover Ratio = Cost of Goods Sold / [(Starting Inventory Value + Ending Inventory Value) / 2]

Sales-to-Inventory Ratio: Measures the inventory velocity, which aids owners in understanding how much value is tied up in inventory in contrast to moving out-the-door. The ratio is calculated by dividing COGS (cost of goods sold) by the average value of your inventory. If this resulting number is too low then items are not moving, if it is too high then sales are happening faster than restocking. This ultimately lead to an increase in backorders.

Sales to Inventory Ratio = Cost of Goods Sold / Inventory

Total Cost of Storage: Refers to the amount of money leaking from the items sitting on the shelf. It includes cash outflows such as warehouse lease, insurance costs, climate control costs, utilities, and security.

Picking Accuracy: Picking speed often determines delivery speed and picking accuracy will make or break customer experience. The ratio is obtained by dividing the number of accurately picked orders by the total number of picked orders. So the best way to measure order accuracy is to track the number of returns due to wrong item shipment and subtract that sum from the total number of orders resulting in real, accurately picked orders.

Orders Picked per Hour: Tracking orders picked per hour can help pinpoint inefficient picking shifts and evaluate the impact of incorporating new technology for this same purpose

Order Cycle Time: This is the amount of time it takes between when an order is placed by a customer and when the order is fulfilled and shipped.

(Time order is shipped from the warehouse – time order is placed by the customer) / (total number of orders shipped)

Picking Efficiency: On another view, if the orders picked per hour are increasing but the order cycle time is steady, then the warehouse staff might be overworking, to which you should hire more labor or look closely for inefficiencies within the picking system.

Cost per Line Item Picked: Refers to the total cost of picking an item including picking and labeling, transportation equipment, safety equipment, and inventory software. Typically you will average this cost across many items over a specified period of time to include labor as well.

Packing Costs: This process requires packaging, boxes, fillers, inventory slips, ads, coupons, and other collaterals all of which contribute to the packing cost. Having a set of predetermined box sizes is cheaper and if the fit is not perfect then air filters will make sure everything is packed safe and tight without affecting the efficiency of choosing from many different box sizes.

Percentage of on-time full delivery: If an order is not on point with time and details, customers will be disappointed. In order to prevent such an occurrence, this measure helps keep that required 100% order accuracy and combines with back-stock orders to help you know how many orders can be fulfiled with all items included in that single order.

Warehouse Capacity Utilization: This metric gives the average amount of warehouse space used over the span of a month or a year. Such a measure is determined by characteristics such as the number of items, the physical size of the items, carrying amount, inbound/outbound order characteristics, and storage configurations. In addition, mobile technology like SKUSavvy can allow owners to eliminate error-prone manual data entry and execute on cycle counts in order to prevent stock-outs. When average capacity sits under 75% and peak capacity is less than 85.8%, then your business has an opportunity for space optimization.

Warehouse Capacity Utilization Percentage = Total Cube of All Inventory / [Total Available Warehouse Space - Non-Storage Space (office, closet) - Difference between ceiling height and storage height] * 100

Inventory count accuracy by location: Having the ability to locate items and properly fulfill the orders where they sit is a critical part of day-to-day management. The lack of such a smooth process can create stock-outs, delayed shipments, and unhappy customers. The target accuracy level is more than 98%, otherwise, there is an opportunity for improvement. Using barcodes and scanning will ensure error reduction and worker productivity enlargement. Cycle counts serve as the underlying method to calculate this metric as cycle counts will tell you how many items are in a bin vs. what the system has recorded for an inventory quantity.

Choosing a focal point amongst all these metrics comes down to figuring out the areas of improvement and the areas of leadership that require a review. The decisions will depend on the point of the process that you find yourself in. Also, it depends on the functionalities available for your warehouse management software as its set-up allows for easier and smoother handling of certain tasks as opposed to others.

Distribution Centers (DCs) handle operations prioritizing quality and capacity which is a new e-commerce challenge for order fulfillment. Owners that report directly to either a C-Suite or a board of directors increased the year-over-year performance by more than 7%. About 65% of facilities are picking cases instead of pallets. There was a loss in 2018 of picking-broken cases of about 6.9%, while there were gains for a full case, partial pallet, and full pallet picking.

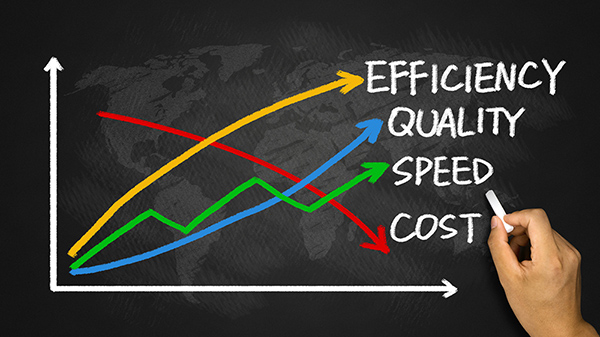

According to Warehousing Education and Research Council (WERC), performance management thrives on consistency and should be supervised among different groups on a yearly basis. Companies following a cost leadership strategy can increase their cost efficiency rate by 23% and those following a mixed strategy can achieve an increase of 25%. Two benchmark performance indicators when analyzing productivity and efficiency within this industry are:

Median Performance

Best practice performance

Supply chain and workforce agility and flexibility are two workforce factors that need to be prioritized in order for firms to remain competitive by guaranteeing an agile supply chain process. Considering all these aspects is of essence to achieve a balanced approach to investments in talent, process improvement, and technology adoption. Such measures rely on granular data to benchmark performance and drive continuous improvements across the DC.